Research Report: Core Infrastructure: Stability in an Uncertain World

When volatility becomes the norm, investors go in search of a sure thing. Over the past two years, public markets have lurched through macroeconomic shocks, inflation spikes and rising rates, leaving many allocators seeking stability and visibility. In this environment, core private infrastructure stands out as one of the few asset classes offering both. With long-term, inflation-linked revenues and little correlation to public markets, core infrastructure is not just a defensive play. It’s a forward-looking strategy for investors who want consistent, durable returns from necessary assets.

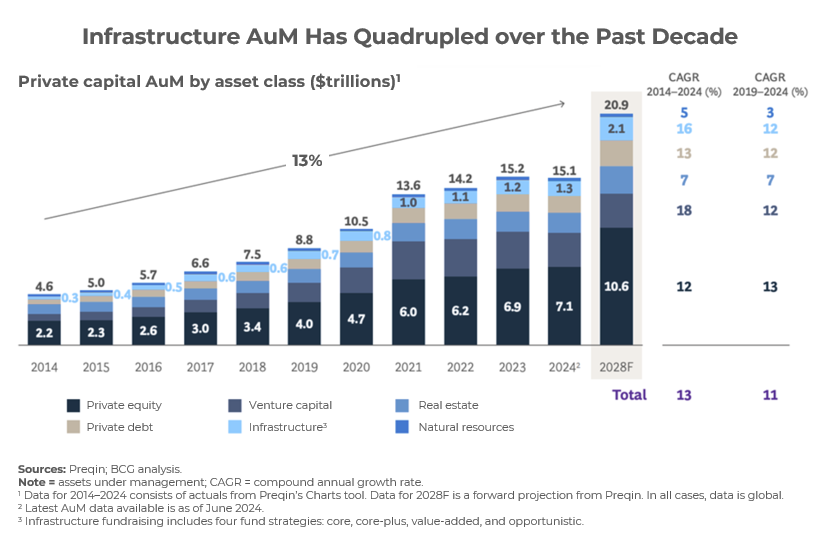

According to JP Morgan, the 10-year annualized volatility for core private infrastructure stands at just 3.4%. This is lower than global bonds (4.3%), US private real estate (5.0%), and dramatically more stable than global equities (14.4%) or listed infrastructure (13.5%). That risk profile is attracting attention. Global infrastructure AUM reached $1.3 trillion in 2024 and is projected to grow to $2 trillion by 2027, per Preqin1.

The Global Renewal Moment

Across the US and Europe, ageing infrastructure is creating an urgent need and opportunity for capital. This isn’t just about roads and bridges – though those are also of serious concern, with around 40% of the 617,000+ bridges in the US over 50 years old. In Europe, two-fifths of the power grids are more than 40 years old2. Meanwhile, decades of underinvestment have left water systems, transport hubs and social infrastructure in need of modernization.

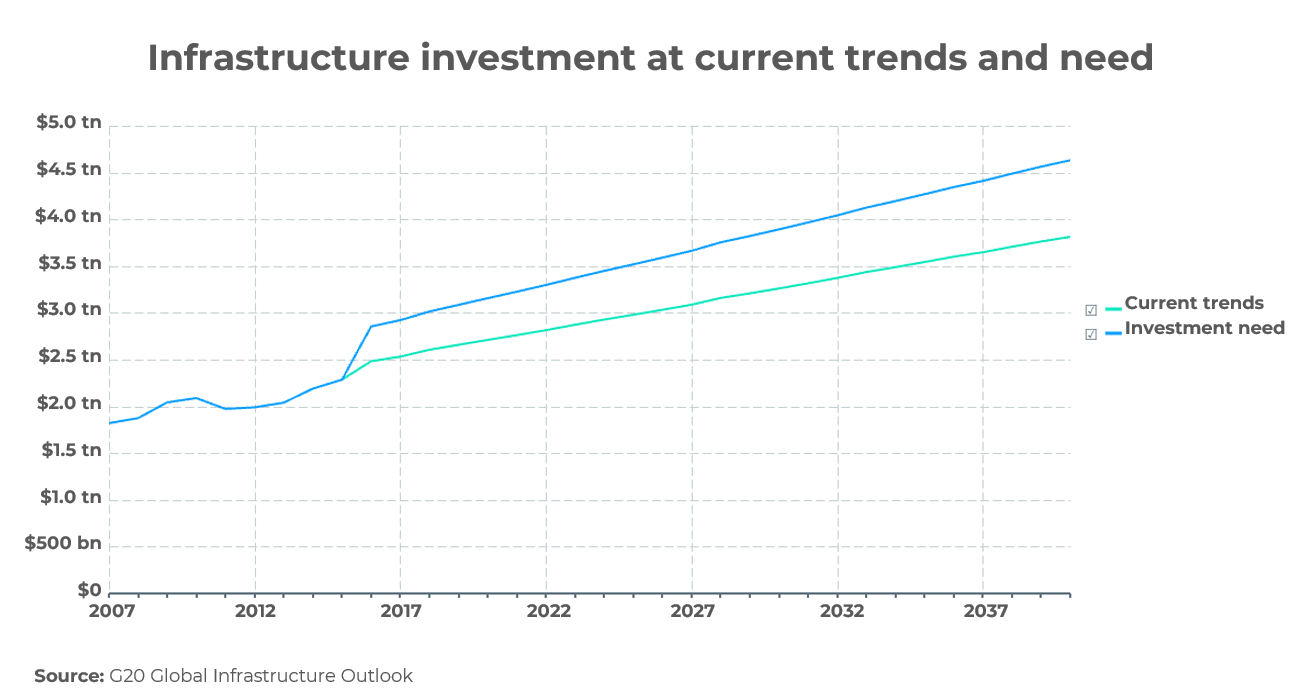

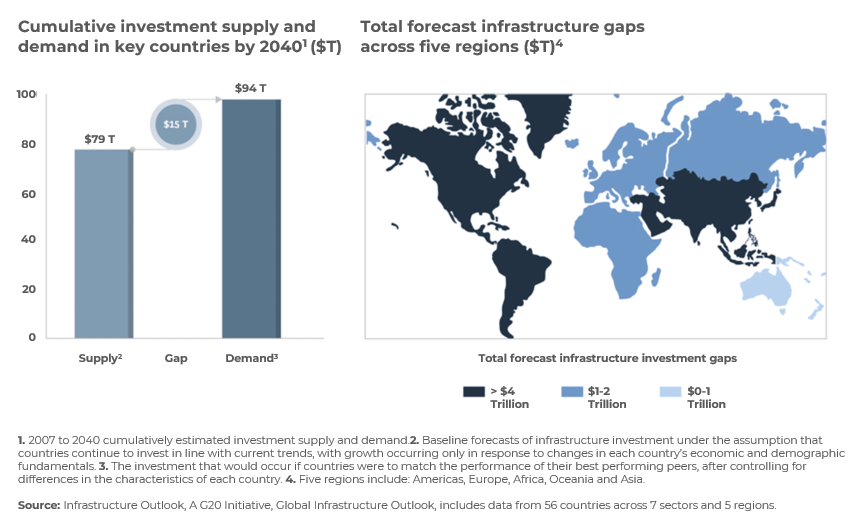

The G20’s Global Infrastructure Outlook3 estimates that if we keep going at the current pace, there will be a $15 trillion deficit between investment needs globally and current trends by 2040.

Clearly, public funding alone is insufficient to meet nations’ massive infrastructure needs, and private capital will play a vital role in bridging this divide. For developing economies, the urgency is even greater as they work to meet ambitious goals around economic development, energy diversification and decarbonization.

Why Now?

Three structural tailwinds are converging:

- Government constraints: Governments worldwide are grappling with high debt levels, limiting their capacity to fund infrastructure projects. This fiscal constraint opens avenues for private capital to step in. Private investment already accounts for 10% of all infrastructure capital globally, according to the London Stock Exchange Group4. That figure is rising. In the past decade alone, private infrastructure assets under management have more than quadrupled to $1.3 trillion, according to BCG from 2014 to 2024.5 This equates to an average growth of 16% per year versus 13% for all private capital. Core infrastructure strategies have driven much of this expansion, with assets in core funds growing at more than twice the pace of opportunistic strategies over the same period, reflecting investor preference for the stability and resilience of essential infrastructure.

- Technology transformation: The integration of digital twin visualization, blockchain logistics, and other InfraTech solutions is making core infrastructure more efficient, measurable and investible. These technologies enable better monitoring, predictive maintenance and optimization of assets, thereby enhancing their performance, life span and investment appeal.

- Sustained demand: Energy, transit, utilities – core infrastructure underpins daily life. So, demand remains robust, even in downturns. The COVID-19 pandemic underscored the resilience of these assets, which continued to operate and provide essential services amid global disruptions.

Predictable Returns Over the Long Term

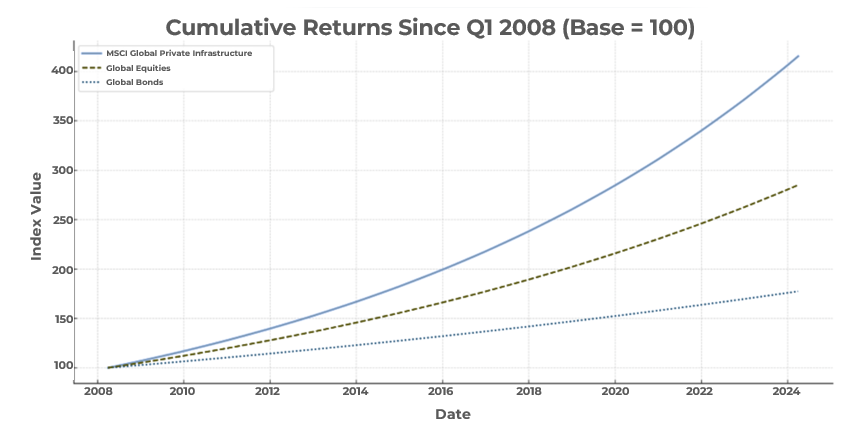

An investment of $1 in core private infrastructure in Q2 2007 would have grown to $4.60 by Q4 2023, outpacing both global equities and bonds over the same period, according to J.P. Morgan Asset Management.6 This pattern of resilience is supported by the MSCI Global Quarterly Private Infrastructure Index, which tracks the performance of global core assets based on actual valuations. From Q1 2008 to Q1 2024, the index more than quadrupled in value, significantly outperforming both public equities and fixed income benchmarks7.

Backed by long-term contracts and regulated frameworks, core infrastructure generates stable, often inflation-linked cash flows with proven resilience across market cycles. An open-ended fund structure aligns well. Investors benefit from ongoing capital deployment, reinvestment flexibility and a longer-term time horizon without forced exits. It also offers a natural fit for capturing value in next-generation infrastructure, from the energy transition to digital connectivity. A hypothetical open-ended infrastructure fund delivering an 11% annual return over a 10-year horizon would achieve a higher multiple on invested capital compared to a closed-end fund requiring a near 20% IRR to match the same multiple, due to the continuous investment and compounding effect enabled by the former8.

Mid-market infrastructure is also drawing interest. With more attractive entry points and the ability to create value through active ownership, this segment offers diversification and higher risk-adjusted return potential. Goldman Sachs estimates the infrastructure mid-market alone represents $1 trillion in investable assets9.

Notably, this part of the market tends to present a steadier deal flow, with nearly 2,000 transactions completed between 2020 and 2023 in the €50 million to €1 billion range, compared to just under 350 at the very top of the scale (€1 billion+)10. This abundance of opportunities is further enhanced by the prevalence of bilateral transactions, where established relationships mean investors can access deals outside of competitive auction processes. Such bilateral deals allow for direct collaboration with management teams, facilitating bespoke solutions and often leading to more favorable investment terms.

Enhancing Portfolio Resilience Through Uncorrelated Returns

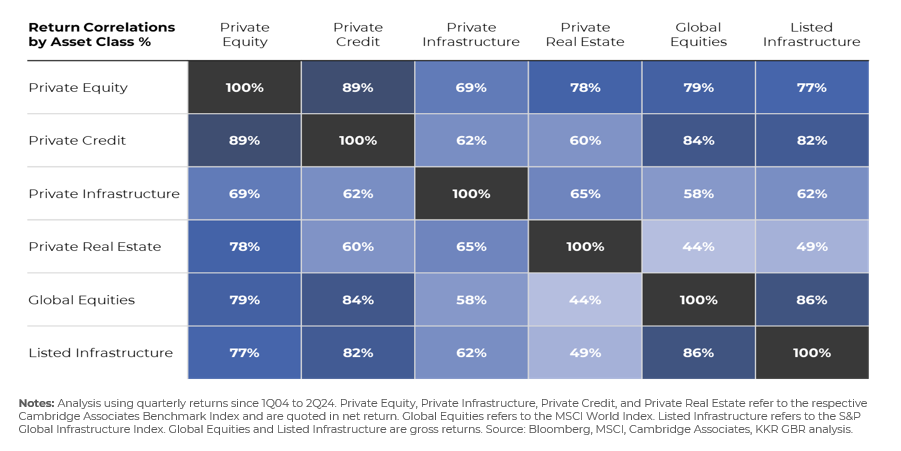

The correlation matrix below illustrates how similarly different asset classes have moved over time, based on quarterly return data.11 A higher correlation indicates that returns tend to move in parallel, while lower correlations suggest return patterns are more independent.

Private infrastructure stands out for its low-to-moderate correlations with both public and private market strategies: just 58% with global equities and in the 60–70% range with other private alternatives like private credit, private equity, and real estate. It behaves differently enough from other asset classes to reduce overall risk, while still delivering strong, stable returns.

A broadening investor base

Private core infrastructure is attracting a wider range of investors. Family offices, for example, are stepping up allocations as they shift beyond traditional private equity into real assets that align with their goals of long-term capital preservation and intergenerational wealth. A 2025 BlackRock survey found that 30% of single-family offices plan to boost infrastructure investments, making it their second most popular private markets strategy after private credit. Three-quarters said they feel optimistic or bullish about infrastructure investing.

As far as strategy, many are eyeing opportunities in value-add and opportunistic (54%) infrastructure. Over half – 51% and 54%, respectively – plan to increase allocations to these segments over the next year, citing the potential for higher returns, favourable structural tailwinds, and the flexibility these strategies offer in navigating today’s volatile market conditions. This shows that infrastructure’s appeal extends beyond its core defensive characteristics, with investors increasingly viewing the asset class as a way to both preserve and grow capital through active value creation.

Volatile and uncertain market environments call for selectivity and a long-term view. Core infrastructure offers a rare combination: durability, income and inflation protection. For investors looking to stabilize portfolios and compound capital over time, core infrastructure is no longer niche – it’s essential.

1 https://www.preqin.com/insights/global-reports/2024-infrastructure

6 https://www.principal.cl/sites/default/files/2024-03/jpmorgan-IIf-flipbook-q4-2023.pdf

8 https://www.cbreim.com/insights/articles/open-end-funds-time-is-money-in-infrastructure-s-new-era

9 https://am.gs.com/en-gb/institutions/insights/article/2024/the-new-mid-market-infrastructure

11 https://www.kkr.com/insights/private-infrastructure-economic-conditions.