Research Report: Secondaries’ Staying Power: What’s Next for Buyers and Sellers

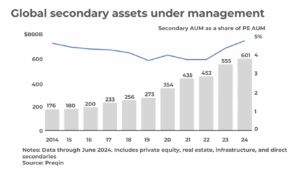

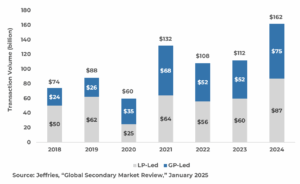

While broader M&A markets continue to contend with macro uncertainty, secondaries have emerged as a rare bright spot – offering flexibility, liquidity, and creative solutions for both investors and managers. Global secondary market transaction volume jumped 45% year over year to $162 billion in 2024, beating the previous record of $132 billion in 20211. That’s not just a cyclical pop. It’s a sign that secondaries are becoming a more central tool for portfolio management, rather than purely for liquidity relief. Bain data shows secondaries AUM totaled $601 billion in 20242. With a growing mix of LP- and GP-led activity, the market is showing durability and depth – regardless of broader dealmaking headwinds.

Several forces are keeping secondaries in high demand:

Liquidity Pressure

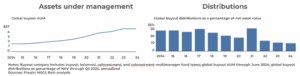

Extended hold periods and limited exit options are fueling appetite for liquidity. Distributions to investors have simply not kept up with the buyout industry’s growing scale over the last decade. While global buyout AUM has tripled over the period, distributions as a percentage of NAV have slid from an average of 29% from 2014 to 2017 to 11% today, according to Bain’s analysis3. Consequently, GPs are feeling the pinch and the pressure to return capital to their LPs. Secondaries are increasingly used as a valve to release the pressure, presenting the opportunity to rebalance portfolios and generate much-desired liquidity.

Growing demand for LP-led deals

LP-led transactions – where the LP exits their position in a PE fund before the end of the fund’s term via a secondary sale – accounted for a record $87 billion chunk of the $162 billion recorded in private secondaries transactions last year. Aside from the obvious liquidity crunch, deal flow for these “classic” secondaries has been driven by more sellers accessing the secondary market as a component of portfolio management, coupled with robust buyer demand. For high quality assets, bid-ask spreads have narrowed, demonstrating the perceived quality of the underlying assets and the growing selectivity of secondary investors. In a competitive environment, average pricing for LP-led transactions across all alternative asset classes reached 89% of NAV at the end of 2024, with traditional buyout strategies pricing at 94% of NAV4.

Boom in continuation vehicles (CVs)

Bain reported that the number of CVs has quadrupled over the past five years, while the total value has nearly tripled5. In 2024, CVs accounted for $63 billion, or 84%, of the $75 billion in GP-led volume. These funds enable PE managers to hold onto their highest-conviction assets for longer, while generating a liquidity option for investors. They also allow the GP to raise further capital and maximize value creation.

Investors increasingly recognize the strong GP alignment in such vehicles, as well as their potential to deliver higher returns relative to traditional LP-led deals. The average underwritten return for a CV is 2-3x net MOIC and 20-25% IRR, according to Schroders and broader market data6. Big buyout managers are now raising dedicated capital for CVs, including TPG, Apollo, Leonard Green and Warburg Pincus.

Specialization and strategy shift

While buyout secondaries still dominate, the market is becoming more diverse with the opportunity set widening across asset classes. Venture and growth secondaries are a growing part of the market for both LP- and GP-led deals, supported by more sustainable valuation multiples and healthier company financials. Still, pricing can be tricky given the risk profile of some early-stage assets, and dependence on their latest valuation rounds.

Momentum is also building in real assets and private credit secondaries. Much like PE secondaries a decade ago, these sectors are starting to attract dedicated pools of capital as new and incumbent investors seek diversified access to income-generating assets. To meet increased demand for real assets, energy and infrastructure-focused GPs are primed to adopt more CVs. Meanwhile, as investor appetite for direct lending continues to grow, so too will the scale and sophistication of the private credit secondary market.

Another notable trend is the growing opportunity in tail-end secondaries. There is a wave of new entrants to the market investing in tail-end portfolios, driving competition and relative pricing. These deals typically involve buying stakes in funds nearing or exceeding their original lifespans often around 14 to 15 years, where managers are under pressure to make final distributions. Monument Group has seen strong activity in this space over the last two years, particularly among fund-of-funds and secondary specialists.

Investors are increasingly recognizing that the opportunity cost of holding mature, illiquid positions can outweigh the perceived benefit of waiting for a better exit. Studies of fund performance suggest that many private equity funds reach peak performance well before Year 12, with subsequent years delivering diminishing returns. By rebalancing out of aging positions, even at a discount, LPs can recycle capital into newer, more productive opportunities — or into strategies better aligned with current market dynamics, so as to enhance long-term portfolio efficiency.

An evolving buyer universe

Established and new pools of capital are actively seeking secondaries investments, pushing up both competition and pricing for diversified portfolios. Institutional investors may have built the secondaries market, but they’re no longer the only players in town. Wealth managers and RIAs are gaining access through ’40 Act registered investment vehicles. These funds are typically semi-liquid or evergreen, often offering liquidity to investors on a quarterly basis. They are gaining attention as a flexible and diversified route to the private markets and provide GPs with an effective way to tap the private wealth channel. According to industry estimates, ’40 Act funds and other evergreen retail vehicles made up nearly a third of secondary fundraising in 2024.7 Firms that have ramped up their private wealth offerings with ’40 Act funds include Blackstone, Coller Capital, KKR and HarbourVest.

A flood of evergreen retail capital has helped drive a record level of available buyside capital for secondaries. This matters for two reasons. First, retail interest brings longer-term, stable capital into the market. Second, it introduces new pricing dynamics. Evergreen vehicles may operate with different return expectations or time horizons than traditional LPs, potentially creating sharper competition for certain deals. GPs managing both institutional funds and evergreen vehicles are now determining how to best allocate deals across vehicles without disrupting their investment programs. It’s an evolving challenge, but one worth watching as evergreen structures gather further momentum.

The secondary market is set to build on 2024’s record volumes, with both LP-led and GP-led activity on track to remain strong in 2025. While market volatility, regulatory uncertainty, and new trade tariffs could pressure deal dynamics, these same forces have the potential to make secondaries even more attractive as liquidity solutions. Longer term structural shifts, including aging portfolios, pressure to deliver DPI, and the growing role of retail capital, will continue to support demand for this rapidly growing part of private markets. For GPs, LPs and investors, secondaries have firmly moved from the sidelines to the center of private market portfolio strategy.

4 https://www.ai-cio.com/news/with-slower-private-equity-exits-secondaries-transactions-tick-up/

7 https://www.caisgroup.com/articles/whats-behind-the-recent-growth-in-private-markets-secondaries